Are you a business owner in a high-risk industry struggling to find a reliable payment processor? Well highriskpay.com got you covered! They’re a leading provider of high-risk merchant accounts, helping you securely accept credit cards, debit cards, e-checks, and other payment methods. Today we will be reviewing High Risk Merchant Account at highriskpay.com & everything you need to know about it before getting started!

Understanding High Risk Merchant Account

A high-risk merchant account is a special kind of account for businesses in industries with a higher chance of chargebacks, fraud, or other problems. Examples include online gambling, adult entertainment, travel, and some e-commerce businesses.

Traditional banks and payment processors see these industries as risky because of the likelihood of fraud or disputes. This can make it hard for high-risk businesses to get a regular merchant account, so they often turn to high-risk merchant account providers.

These special accounts usually have more flexible rules and are open to riskier businesses. However, they also tend to have higher fees and stricter terms because they take on more risk.

For high-risk merchants, it’s crucial to research potential providers carefully. Look into their fees, contract terms, and reputation to make sure they can handle payments well and manage risk effectively.

What Are High Risk Payment Processor?

High Risk payment processors specialize in handling transactions for businesses in industries prone to fraud or chargebacks, such as adult entertainment, online gaming, or debt relief. These businesses often struggle to get merchant accounts from regular banks or processors due to the higher risk associated with their operations.

To assist such merchants, high risk payment processors offer a variety of services like fraud protection, chargeback management, and support for multiple currencies. They also have a higher tolerance for risk and more flexible underwriting criteria, making it easier for high risk businesses to get a merchant account and start processing payments.

However, these processors usually charge higher fees and have stricter contract terms compared to regular processors, reflecting the increased risk they take on.

Merchants should carefully review the terms of their contract with a high risk payment processor and research the provider’s reputation and track record. This ensures they are working with a reputable company that can help manage their risk and ensure smooth payment processing.

Why You Need To Have High-Risk Merchant account with highriskpay.com?

In some industries, like online gambling or adult entertainment, businesses face more challenges when it comes to accepting payments. This is because they are considered high risk, which means there’s a greater chance of issues like chargebacks or fraud.

Traditional banks and payment processors may be cautious about working with these businesses because of these risks. This can make it hard for high-risk merchants to take payments from customers, which can slow down their growth.

But there are solutions available. High-risk merchant accounts, like those from highriskpay.com, are designed specifically for these types of businesses. They have more flexibility and are more willing to work with high-risk merchants.

However, it’s important for high-risk merchants to be cautious. Before signing up with a high-risk merchant account provider, they should carefully read and understand the terms of their contract. They should also research the provider’s reputation to ensure they can trust them to process payments effectively and manage their risk.

Also Read | Moviesda 2023: Tamil Cinema’s Digital Odyssey Unveiled

Documents Required For High-Risk Merchant Account

The particular documents necessary to apply for a high-risk merchant account through highriskpay.com may vary, however common documents that may be required include:

- Business registration and tax documentation

- Bank statements

- Processing history

- Website and marketing materials

- Identity and address verification

Wanna Open A New Account At highriskpay.com? Here’s How!

High-risk merchants are businesses that are considered to have a higher risk of chargebacks or fraudulent activities. Highriskpay.com is a payment processor that provides payment solutions for high-risk merchants.

A high-risk merchant account with Highriskpay.com works as follows:

- First, the merchant applies for an account with Highriskpay.com and provides information about their business.

- Next, Highriskpay.com assesses the application and determines the merchant’s risk level. If the merchant is approved, they are set up with a merchant account that allows them to process credit card payments.

- Once the merchant integrates the payment solution into their website or payment process, they can begin accepting payments from customers.

Highriskpay.com takes care of processing transactions, including security and fraud monitoring. The funds from the transactions are deposited into the merchant’s account. It’s important to note that high-risk merchants may be subject to higher fees and stricter processing regulations than traditional merchants.

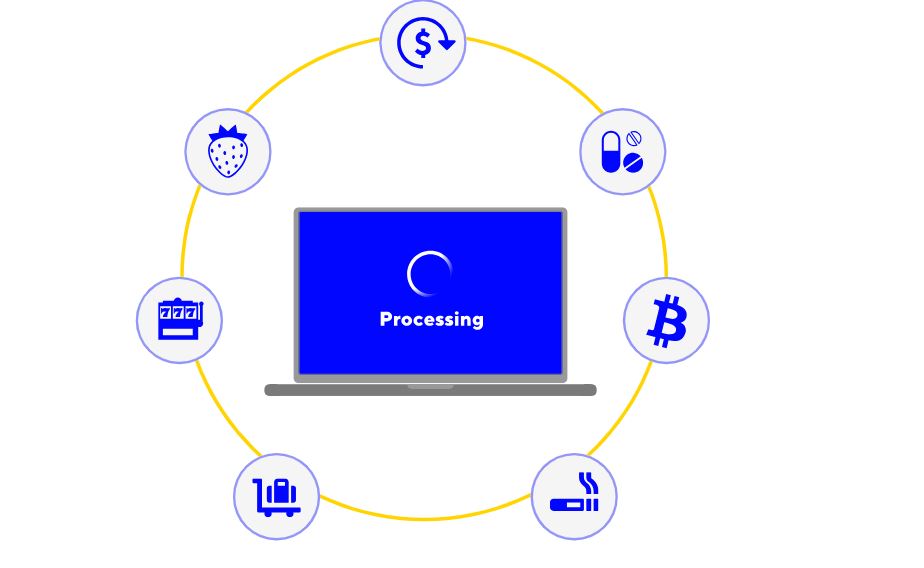

Most Common Types Of High-Risk Industries

In the world of commerce, certain businesses are classified as high-risk industries. These businesses are seen as having a greater likelihood of causing issues like chargebacks, fraud, or financial losses for merchant service providers and processors. Examples of such industries include:

- Adult entertainment

- Online gaming and gambling

- Dating and escort services

- Pharmaceuticals and supplements

- Timeshares

- Travel and tourism

- E-cigarettes and vape products

- Debt collection and loan services

- Telemarketing and infomercials

- Technology and software sales

It’s important to note that this list is not exhaustive, and different merchant service providers may have varying classifications for industries.

Benefits Of High Risk Merchant Account at highriskpay.com

Benefits of a high-risk merchant account can greatly benefit businesses in various ways. Firstly, it provides access to payment processing services, enabling businesses in high-risk industries to accept credit and debit card payments. This accessibility is crucial for expanding customer reach and increasing sales.

Additionally, a high-risk merchant account reduces the risk of account closure, which is particularly significant for high-risk merchants who may face a higher risk of having their accounts closed by their payment processor. By having a high-risk merchant account, businesses can enjoy a more stable payment processing environment.

Moreover, high-risk merchant accounts often come with higher processing limits compared to traditional merchant accounts. This higher limit allows high-risk businesses to process larger transactions, which is essential for businesses that deal with high-volume transactions.

Another advantage is the tailored fraud protection services that come with high-risk merchant accounts. These services are designed to help businesses mitigate the risk of fraud and chargebacks, providing a secure environment for both businesses and customers.

Finally, having a high-risk merchant account can significantly enhance the customer experience. By providing a reliable and secure way to make online purchases, businesses can improve customer trust and loyalty, leading to increased sales and profitability.

It is important to note that the specific advantages of a high-risk merchant account may vary depending on the provider and the individual needs of the business. However, the benefits mentioned above are commonly associated with high-risk merchant accounts and highlight the importance of having one for businesses operating in high-risk industries.

To Sum It Up

In conclusion, finding a reliable and affordable high-risk merchant account provider is crucial for the success of your business. Highriskpay.com offers specialized merchant accounts and payment processing solutions for high-risk businesses. Consider exploring their services to see if they align with your needs. Additionally, remember to conduct thorough research and compare different providers to make an informed decision that best suits your business requirements.

Also Read | Unveiling the Wonders of Aiotechnical.com Health & Beauty!

Leave a Reply