The cryptocurrency market has experienced significant growth in recent years, attracting a diverse range of investors and traders. However, with this surge in popularity, the number of cryptocurrency scams has also increased. It’s crucial for participants in the market to be aware of potential threats and scams to protect their investments. In this blog post, we’ll explore the 10 most common crypto scams in 2023 and offer insights on how to avoid falling victim to them.

Crypto Scams: A Growing Threat for Unsuspecting Investors

The decentralized nature of the crypto industry, lacking central authorities and irreversible transactions, makes it a prime target for scammers. These malicious actors are constantly devising new methods to steal users’ cryptocurrencies, resulting in significant losses.

According to the Federal Trade Commission, between January 2021 and June 2022, over $1 billion in crypto was stolen from over 46,000 victims through various scams. This alarming figure likely underestimates the true extent of the issue, as many victims may not report their losses.

Crypto investors need to be aware of the different types of scams prevalent in the industry to protect their assets. This article explores the top 10 most common crypto scams in 2023, empowering investors to make informed decisions and avoid falling prey to these malicious tactics.

Top 10 Most Common Crypto Scams in 2023

Explore the landscape of crypto scams in 2023, as scammers adapt to exploit vulnerabilities in the decentralized world of cryptocurrencies. Learn about the prevalent schemes threatening investors and discover crucial insights to safeguard assets in this dynamic and evolving space.

10. Cryptocurrency Scams on Social Media

Social media platforms like Twitter, Instagram, and TikTok are becoming breeding grounds for crypto scams. Scammers exploit these platforms by mimicking well-known brands and impersonating celebrities to promote fraudulent schemes. Bots are particularly active, promoting fake cryptocurrency projects to unsuspecting users.

In June 2023, the European Consumer Organization (BEUC) released a report exposing the lax policies of social media platforms like Instagram and TikTok, which allow these scams to flourish and target vulnerable teenagers.

Fortunately, protecting yourself is straightforward. Be cautious when interacting with crypto projects trending on social media. Verify their legitimacy and avoid fake accounts to keep your assets safe.

9. AI-Powered Crypto Scams: A New Threat to Investors

The rise of artificial intelligence (AI) has unfortunately seen its application in the realm of crypto scams. These sophisticated scams utilize AI chatbots, virtual assistants, and deepfakes to deceive investors.

Scammers can leverage AI chatbots to engage with individuals, providing fake investment advice, promoting fraudulent tokens and Initial Coin Offerings (ICOs), or offering unrealistically high-yield opportunities. Deepfakes can be used to create convincing videos and audio recordings featuring celebrities or industry experts endorsing fake projects and luring investors into traps.

The ability of AI to automate and personalize scams makes them even more dangerous. Investors must remain vigilant and exercise caution when encountering seemingly helpful AI-powered platforms or investment advice within the crypto space.

8. Beware of Fake Celebrity Endorsements in Crypto Scams

Scammers are exploiting the trust and fame of high-profile figures like Prince Harry, Meghan Markle, Bill Gates, Mark Zuckerberg, and Sir Richard Branson, using their faces and voices to promote fake cryptocurrency projects and investment scams. Even deepfake technology is being used, creating videos of celebrities endorsing projects they have no connection to.

One particularly convincing example involved a deepfake video of Elon Musk promoting a sham crypto project, promising a 30% return in just three months.

To protect yourself from these scams, always do your own research before investing in any cryptocurrency project. Verify the legitimacy of the project itself, its team members, and any celebrity endorsements associated with it. Remember, if it sounds too good to be true, it probably is. Don’t rush into any investment decision. Take your time to research and understand the risks before putting your money at risk.

7. Beware of Romance Scammers: Protecting Your Heart and Wallet

Imagine falling in love online, only to discover your sweetheart is a wolf in sheep’s clothing. This is the chilling reality of cryptocurrency romance scams, where criminals prey on emotions to steal your digital wealth. These scams often begin on social media or dating apps. The perpetrators meticulously build romantic connections, crafting elaborate personas and forging emotional bonds over weeks or even months. Their goal? To gain your trust and ultimately manipulate you into handing over your precious crypto assets.

They may lure you with promises of a shared future, claiming to have discovered a lucrative crypto investment opportunity. They might even fabricate their own success stories to convince you of the scheme’s authenticity. Once you’ve invested, their true colors may emerge. They may vanish without a trace, leaving you heartbroken and financially devastated. Or, they may continue the charade, extracting even more funds before disappearing.

Remember, love shouldn’t involve financial pressure. If someone you’ve met online asks you to invest in cryptocurrency, proceed with extreme caution. Verify the information independently, prioritize your financial security, and never let your emotions cloud your judgment. Don’t let the love that seeks your crypto steal your heart and your hard-earned assets. Be vigilant and protect yourself from this growing online threat.

6. Crypto Investment Scams: Empty Promises, Big Losses

Investment scams entice individuals with promises of substantial returns by encouraging early investment in a new cryptocurrency project. Perpetrators, assuming roles like investment managers, falsely pledge significant profits from the yet-to-be-launched project. The scams initiate with unsolicited offers, often posing as cryptocurrency investment opportunities, directing users to seemingly authentic websites for further details. These websites create an illusion of legitimacy, enticing users to invest quickly for rapid returns.

To safeguard against such scams, users must exercise caution when encountering unsolicited investment offers through email, social media, or other communication channels. Legitimate investment opportunities seldom emerge through unsolicited means, making skepticism crucial in the face of enticing yet unverified offers.

5. Crypto Platform Scams: Protect Your Funds

Beware of fake crypto platforms designed to steal your funds. These platforms often closely mimic legitimate sites, making detection difficult. They may function normally at first, even allowing small withdrawals. However, once you invest more, they may disappear or refuse withdrawal requests under dubious pretenses.

To stay safe, double-check the website’s domain name for any misspellings or unusual variations. Verify if the exchange is listed on trusted regulatory websites or holds certifications/memberships in industry organizations. Remember, if it sounds too good to be true, it probably is.

4. Beware Crypto Ponzi Schemes: Early Returns Mask a Fraudulent System

Cryptocurrency Ponzi schemes lure investors with the promise of high returns, but they’re built on a house of cards. Early investors get paid with money from new recruits, not from actual profits. When new investors dry up, the scheme collapses, leaving victims with nothing.

These scams are often disguised well, as evidenced by the downfall of Terra (LUNA), which even fooled some seasoned investors. However, there are red flags to watch for:

- Guaranteed high returns: No investment can offer guaranteed high returns, so be wary of such promises.

- Lack of transparency: If the project doesn’t clearly explain how it generates returns, proceed with caution.

- Pressure to recruit: Legitimate projects don’t pressure you to recruit others.

- Focus on referral bonuses and multilevel marketing: These structures typically indicate a focus on recruitment over actual investment.

By being cautious and recognizing these red flags, you can protect yourself from falling prey to cryptocurrency Ponzi schemes.

3. Giveaway Scams

Fraudsters in giveaway scams deceive by pledging to multiply cryptocurrency sent, tricking individuals into financial losses through fund transfers. Beware of deceptive offers promising to double or multiply your crypto holdings. These “giveaway” scams exploit your desire for quick gains, ultimately leaving you with empty pockets.

The typical modus operandi of these scams involves impersonating well-known individuals or organizations and soliciting users to send cryptocurrency. Due to the irreversible nature of crypto transactions, once funds are sent to the specified “giveaway” address, they cannot be recovered.

To safeguard against such scams, it is crucial to educate oneself and recognize the characteristics of crypto giveaway fraud. It is important to note that legitimate giveaways or promotions usually do not require users to send funds or divulge personal information in advance.

2. Rug Pulls: A Treacherous Trap in Crypto

In the world of crypto, rug pulls are cunning schemes designed to steal your hard-earned funds. Developers create a seemingly legitimate project, luring investors with promises of riches. However, once they’ve amassed enough money, they vanish, leaving investors with worthless tokens.

These incidents commonly take place within projects operating on blockchain platforms such as Ethereum, where smart contracts govern project functions. Perpetrators typically establish what appears to be a legitimate project, attract investors, and persuade them to invest funds or acquire tokens. Once a substantial amount of funds or liquidity has been amassed, scammers exploit vulnerabilities within the smart contract to drain the resources. These vulnerabilities often exist from the project’s inception but remain concealed within the code.

Recognizing common traits of rug pulls can aid in avoiding falling victim to such scams. Typically, rug pull projects lack transparency regarding the identities of developers or team members, often using pseudonyms or providing limited background information. Additionally, scammers may employ false or exaggerated claims about the project’s potential, partnerships, or future developments to lure in investors. Projects susceptible to rug pulls may also exhibit tokenomics heavily favoring developers or early investors.

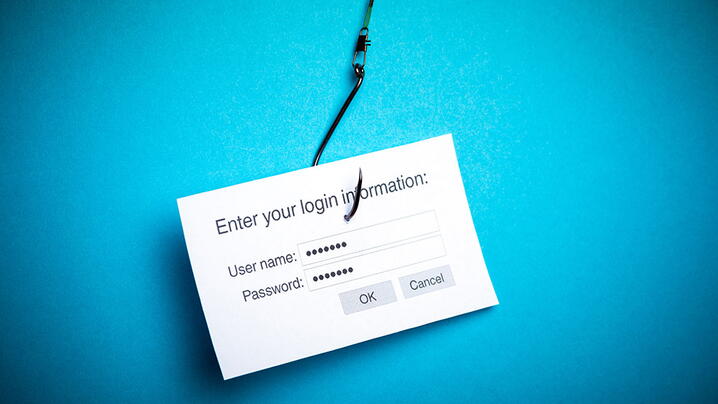

1. Phishing Scams: Deceitful Hooks to Steal Your Data

Phishing scams are prevalent online, and the world of cryptocurrency is no exception. These scams aim to trick users into divulging sensitive information, like their wallet’s private keys, which grant access to their crypto funds.

While phishing scams are common across the internet, they have also proliferated in the cryptocurrency space. In the crypto realm, scammers target users to gain access to their wallet’s private keys, enabling unauthorized access to stored funds. The primary objective is to illicitly obtain user data, including login credentials and credit card details.

Scammers use emails pretending to be from legitimate sources, often with urgent requests and links to fake websites. Once users click on these links and enter their private keys, the scammers steal their cryptocurrency.

To stay safe, be extra cautious of unsolicited emails or messages, especially those requesting personal information or urging immediate action. Always verify the sender’s legitimacy and avoid clicking on suspicious links. Remember, no legitimate organization will ever ask for your private keys via email.

Bottom Line

In 2023, despite an overall decline in crypto scams, evolving tactics highlight a persistent threat in the volatile, unregulated market. With sophisticated AI tools and impersonation methods, investors must stay vigilant. While scam revenue has decreased, the risks persist, notably with ransomware and social media scams. Continued awareness, education, regulatory measures, and technological advancements offer hope, but individual responsibility is paramount. Mitigating risks involves staying informed, conducting due diligence, and prioritizing secure wallet management. As the crypto space evolves, collective vigilance remains crucial against the ever-changing strategies of cybercriminals.

Explore our other blogs on crypto for further insights – Cryptocurrency Wallets , Ways To Mine Cryptocurrency

Leave a Reply